Abstract

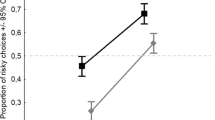

Decision-makers present a systematic tendency to avoid ambiguous options for which the level of risk is unknown. This ambiguity aversion is one of the most striking decision-making biases. Given that human choices strongly depend on the options’ presentation, the purpose of the present study was to examine whether ambiguity aversion influences the framing effect during decision making. We designed a new financial decision-making task involving the manipulation of both frame and uncertainty levels. Thirty-seven participants had to choose between a sure option and a gamble depicting either clear or ambiguous probabilities. The results revealed a clear preference for the sure option in the ambiguity condition regardless of frame. However, participants presented a framing effect in both the risk and ambiguity conditions. Indeed, the framing effect was bidirectional in the risk condition and unidirectional in the ambiguity condition given that it did not involve preference reversal but only a more extreme choice tendency.

Similar content being viewed by others

References

Camerer, C., & Weber, M. (1992). Recent developments in modeling preferences: Uncertainty and ambiguity. Journal of Risk and Uncertainty, 5, 325–370.

Cassotti, M., Habib, M., Poirel, N., Aïte, A., Houdé, O., & Moutier, S. (2012). Positive emotional context eliminates framing effect in decision making. Emotion, 12(5), 926–931.

De Martino, B., Kumaran, D., Seymour, B., & Dolan, R. J. (2006). Frames, biases, and rational decision-making in the human brain. Science, 313, 684–687.

De Martino, B., Harrison, N. A., Knafo, S., Bird, G., & Dolan, R. J. (2008). Explaining enhanced logical consistency during decision making in autism. Journal of Neuroscience, 28(42), 10746–10750.

De Martino, B., Camerer, C. F., & Adolphs, R. (2010). Amygdala damage eliminates monetary loss aversion. Proceedings of the National Academy of Sciences, 107(8), 3788–3792.

De Neys, W. (2006). Automatic-heuristic and executive-analytic processing during reasoning: Chronometric and dual-task considerations. The Quarterly Journal of Experimental Psychology, 59(6), 1070–1100.

De Neys, W. (2012). Bias and conflict: A case for logical intuitions. Perspectives on Psychological Science, 7, 28–38.

Ellsberg, D. (1961). Risk, ambiguity and Savage axioms. Quaterly Journal of Economics, 75, 643–669.

Evans, J. S. B. T. (2010). Thinking twice: Two minds in one brain. Oxford: Oxford University Press.

Ho, J. L. Y., Keller, L. R., & Keltika, P. (2002). Effects of outcome and probabilistic ambiguity on managerial choices. The Journal of Risk and Uncertainty, 24(1), 47–74.

Hsu, M., Bhatt, M., Adolphs, R., Tranel, D., & Camerer, C. F. (2005). Neural systems responding to degrees of uncertainty in human decision-making. Science, 310, 1680–1683.

Huettel, S. A., Stowe, C. J., Gordon, E. M., Warner, B. T., & Platt, M. L. (2006). Neural signatures of economic prefer- ences for risk and ambiguity. Neuron, 49, 765–775.

Inukai, K., & Takahashi, T. (2009). Decision under ambiguity: Effects of sign and magnitude. International Journal of Neuroscience, 119, 1170–1178.

Kahn, B. E., & Sarin, R. K. (1988). Modeling ambiguity in decisions under uncertainty. Journal on Consumer Research, 15, 265–272.

Kahneman, D. (2003). A perspective of judgment and choice. American Psychologist, 58, 697–720.

Kahneman, D., & Frederick, S. (2007). Frames and brains: Elicitation and control of response tendencies. Cognitive Science, 2, 45–46.

Kahneman, D., & Tversky, A. (1983). Choices, values and frames. American Psychologist, 39, 341–350.

Keren, G., & Gerritsen, E. M. L. (1999). On the robustness and possible accounts of ambiguity aversion. Acta Psychologica, 103, 149–172.

Levy, I., Snell, J., Nelson, A. J., Rustichini, A., & Glimcher, P. W. (2010). Neural representation of subjective value under risk and ambiguity. Journal of Neurophysiology, 103(2), 1036–1047.

Loewenstein, G., Rick, S., & Cohen, J. D. (2008). Neuroeconomics. Annual Review of Psychology, 59, 647–672.

Pulford, B. D., & Colman, A. M. (2008). Size doesn’t really matter: Ambiguity Aversion in Ellsberg Urns with Few Balls. Experimental Psychology, 55, 31–37.

Reyna, V. F. (2004). How people make decisions that involve risk: A dual-processes approach. Current Directions in Psychological Science, 13(2), 60–66.

Reyna, V. F. (2012). A new intuitionism: Meaning, memory, and development in fuzzy-trace theory. Judgment and Decision Making, 7(3), 332–359.

Rubaltelli, E., Rumiati, R., & Slovic, S. (2010). Do ambiguity avoidance and the comparative ignorance hypothesis depend on people’s affective reactions? Journal of Risk and Uncertainty, 40(3), 243–254.

Smith, K., Dickhaut, J., McCabe, K., & Pardo, J. V. (2002). Neuronal substrates for choice under ambiguity, risk, gain, and losses. Management Science, 48(6), 711–718.

Stanton, S. J., Mullette-Gillman, O. A., McLaurin, E. E., Kuhn, C. M., LaBar, K. S., Platt, M. L., & Huettel, S. A. (2011). Low- and high-testosterone individuals exhibit decreased aversion to economic risk. Psychological Science, 22(4), 447–453.

Tversky, A., & Kahneman, D. (1981). The framing of decisions and psychology of choice. Science, 211, 453–458.

Tymula, A., Rosenberg Belkamer, L. A., Roy, A. K., Ruderman, L., Manson, K., Glimcher, P. W., & Levy, I. (2012). Adolesxents’s risk taking behavior is driven by tolerance to ambiguity. Proceeding of the Nationnal Academy of Sciences, 109(42), 17135–17140.

Wang, X. T. (1996). Framing effects: Dynamics and task domains. Organizational Behavior and Human Decision Processes, 68, 145–157.

Zheng, H., Wang, X. T., & Zhu, L. (2010). Framing effects: Behavioral dynamics and neural basis. Neuropsychologia, 48, 3198–3204.

Author information

Authors and Affiliations

Corresponding author

Additional information

A. Osmont and M. Cassotti contributed equally to this article.

Rights and permissions

About this article

Cite this article

Osmont, A., Cassotti, M., Agogué, M. et al. Does ambiguity aversion influence the framing effect during decision making?. Psychon Bull Rev 22, 572–577 (2015). https://doi.org/10.3758/s13423-014-0688-0

Published:

Issue Date:

DOI: https://doi.org/10.3758/s13423-014-0688-0